Risk Management For Prop Traders

Stop blowing up prop firm accounts. Automate your daily loss limits and trade with discipline using our cloud-based risk manager. Now supporting both Rithmic and Tradovate platforms. Focus on your strategy, let QuantGuard handle the guardrails.

Automated Risk Guardrails for Rithmic & Tradovate Traders

Set your limits once, trade with confidence knowing QuantGuard enforces the rules across both platforms.

Unified Risk Management for Rithmic & Tradovate

QuantGuard operates 24/7 on secure infrastructure, providing seamless risk management across both major trading platforms. Focus on your strategy while we handle the guardrails.

Multi-Platform Integration

Seamlessly connect both Rithmic and Tradovate accounts.

Work with your preferred trading platform and prop firm. QuantGuard provides unified risk management across both Rithmic and Tradovate, with more platforms coming soon.

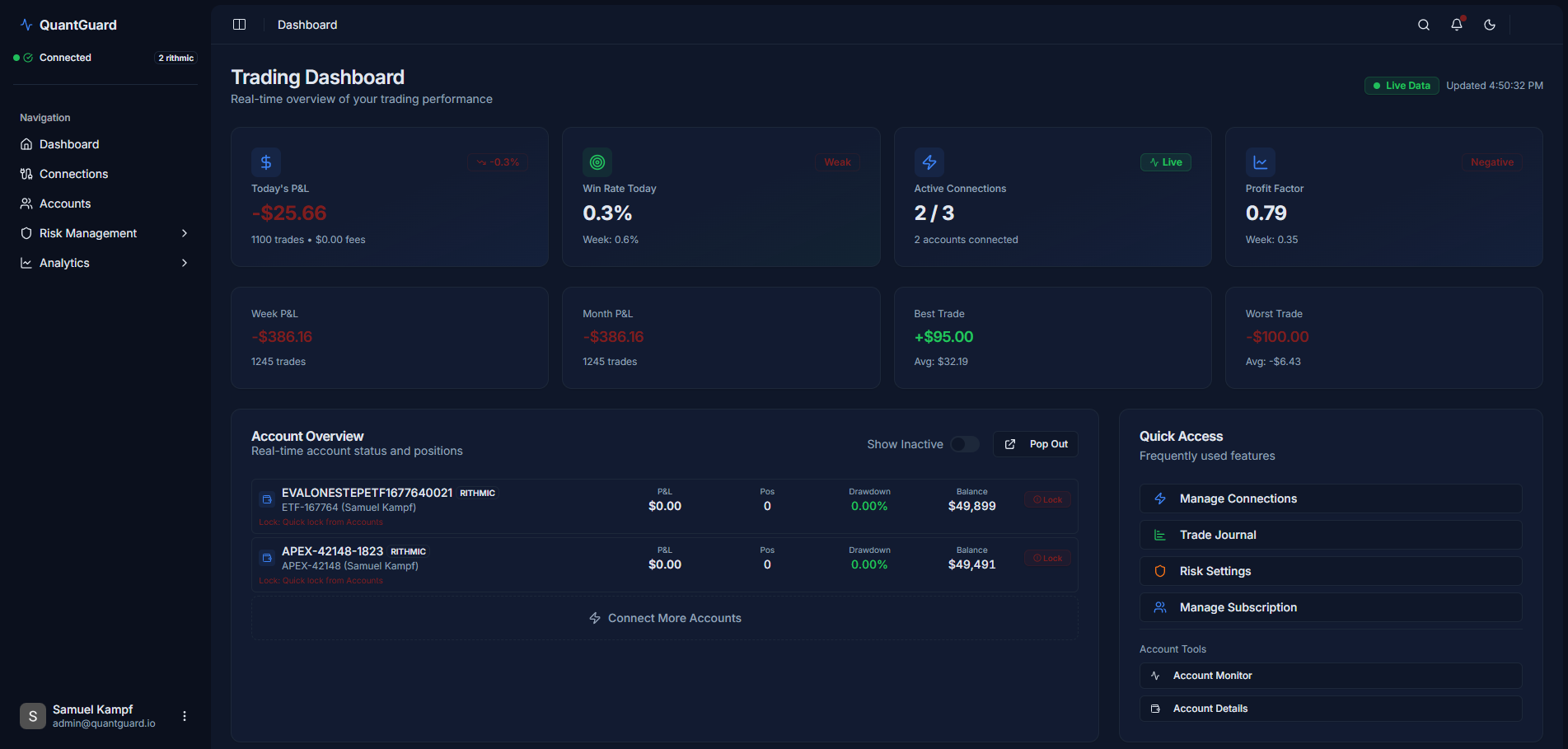

Real-Time Cross-Platform Monitoring

See your risk status instantly across all Rithmic and Tradovate accounts.

The unified dashboard provides a clear, real-time overview of your daily P/L, active risk rules, and account status across both platforms, ensuring you always know where you stand.

Cloud-Based 24/7 Protection

Never miss a tick. QuantGuard runs continuously on secure cloud servers.

Your risk rules are enforced reliably across all connected platforms, even when your PC is off. Protecting you from unexpected market moves on both Rithmic and Tradovate accounts.

Seamlessly connect both Rithmic and Tradovate accounts.

Work with your preferred trading platform and prop firm. QuantGuard provides unified risk management across both Rithmic and Tradovate, with more platforms coming soon.

See your risk status instantly across all Rithmic and Tradovate accounts.

The unified dashboard provides a clear, real-time overview of your daily P/L, active risk rules, and account status across both platforms, ensuring you always know where you stand.

Never miss a tick. QuantGuard runs continuously on secure cloud servers.

Your risk rules are enforced reliably across all connected platforms, even when your PC is off. Protecting you from unexpected market moves on both Rithmic and Tradovate accounts.

Protect Your Trades Today

Stop letting preventable errors sabotage your trading success. Implement automated risk controls across Rithmic and Tradovate platforms and trade with confidence.

Traders Trust QuantGuard

Hear from futures traders who rely on QuantGuard to protect their capital and enforce discipline.

“QuantGuard saved me from blowing my funded account during a volatile news event. The auto-lock feature is a lifesaver!”

John D.Futures Trader“Finally, a risk tool that just works. Set my rules, and it does the rest. Runs reliably in the cloud.”

Sarah K.Prop Firm Trader

“Managing risk across multiple prop accounts used to be a nightmare. QuantGuard makes it simple from one dashboard.”

Mike P.Multi-Account Trader“The peace of mind knowing my DLL is automatically enforced is priceless. Lets me focus purely on my edge.”

Jessica L.Swing Trader

“Easy to set up, reliable, and does exactly what it promises. Highly recommended for any Rithmic trader.”

David R.Scalper“Switched from a competitor and haven't looked back. QuantGuard's cloud setup is far more stable.”

Emily T.Day Trader

Simple, Transparent Pricing

Choose a plan that fits your trading needs with no hidden fees.

All sales are final. See our Terms of Service for refund policy details.

Basic

Perfect for solo or beginner futures traders.

$75 / month

- 2 connections

- 5 accounts per connection

- Multi Prop Support

- Instant Access

Pro

For traders with multiple broker connections.

$100 / month

- 4 connections

- 10 accounts per connection

- Multi Prop Support

- Instant Access

Unlimited

For pros needing multiple connections and full features.

$150 / month

- Unlimited Connections

- 20 Accounts Per Connection

- 24/7 Persistent Connection

- Early access to new features

- Instant Access

Frequently asked questions

Have questions about how QuantGuard works? Find answers to common inquiries below.

What platforms does QuantGuard support?

QuantGuard fully supports both Rithmic and Tradovate platforms. You can connect accounts from either platform or use both simultaneously. We continue to expand platform support based on user demand.

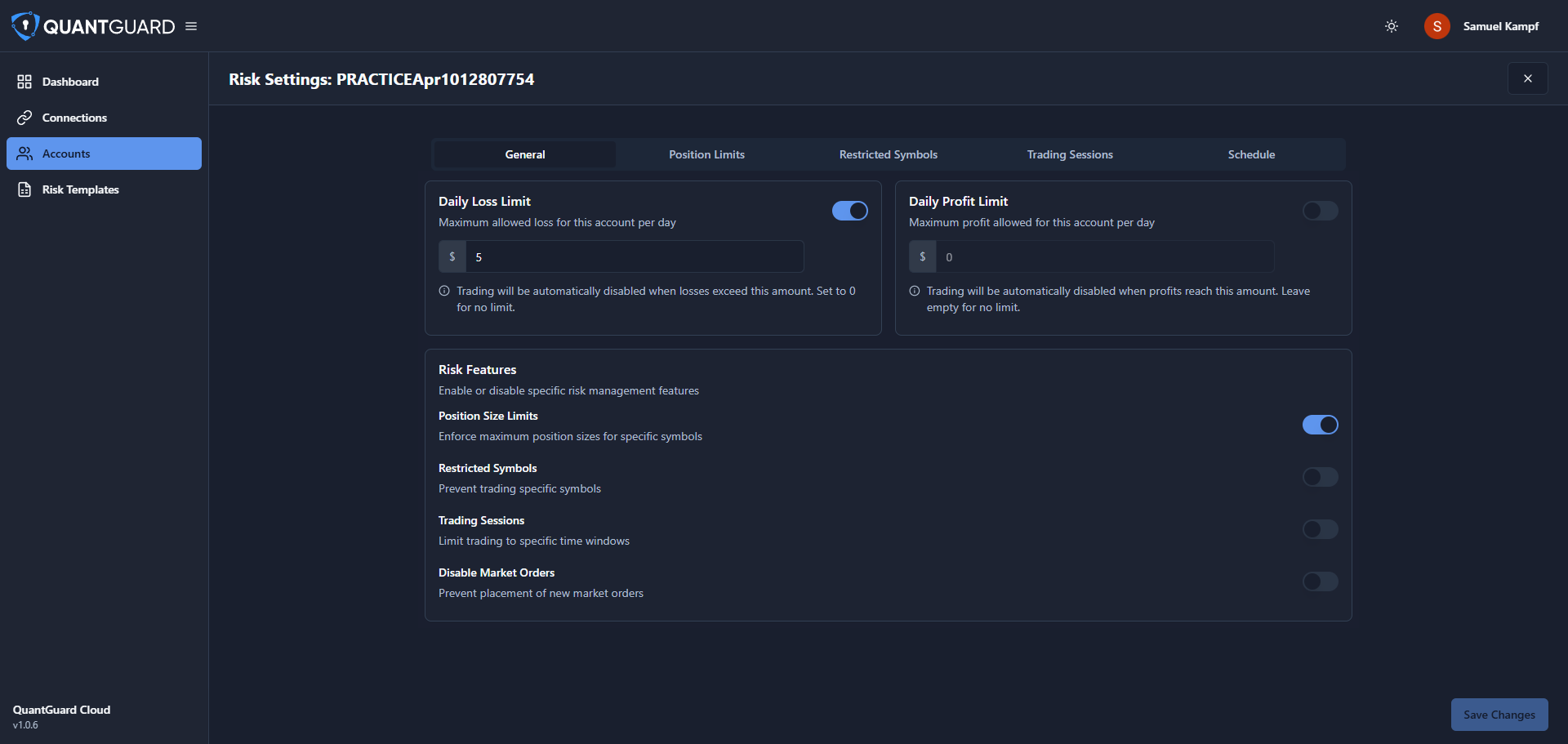

How does QuantGuard enforce the Daily Loss Limit (DLL)?

Once connected to your Rithmic or Tradovate account, QuantGuard monitors your Net P/L in real-time. If it breaches your set DLL, it automatically sends a command to lock trading for that account until the next session reset.

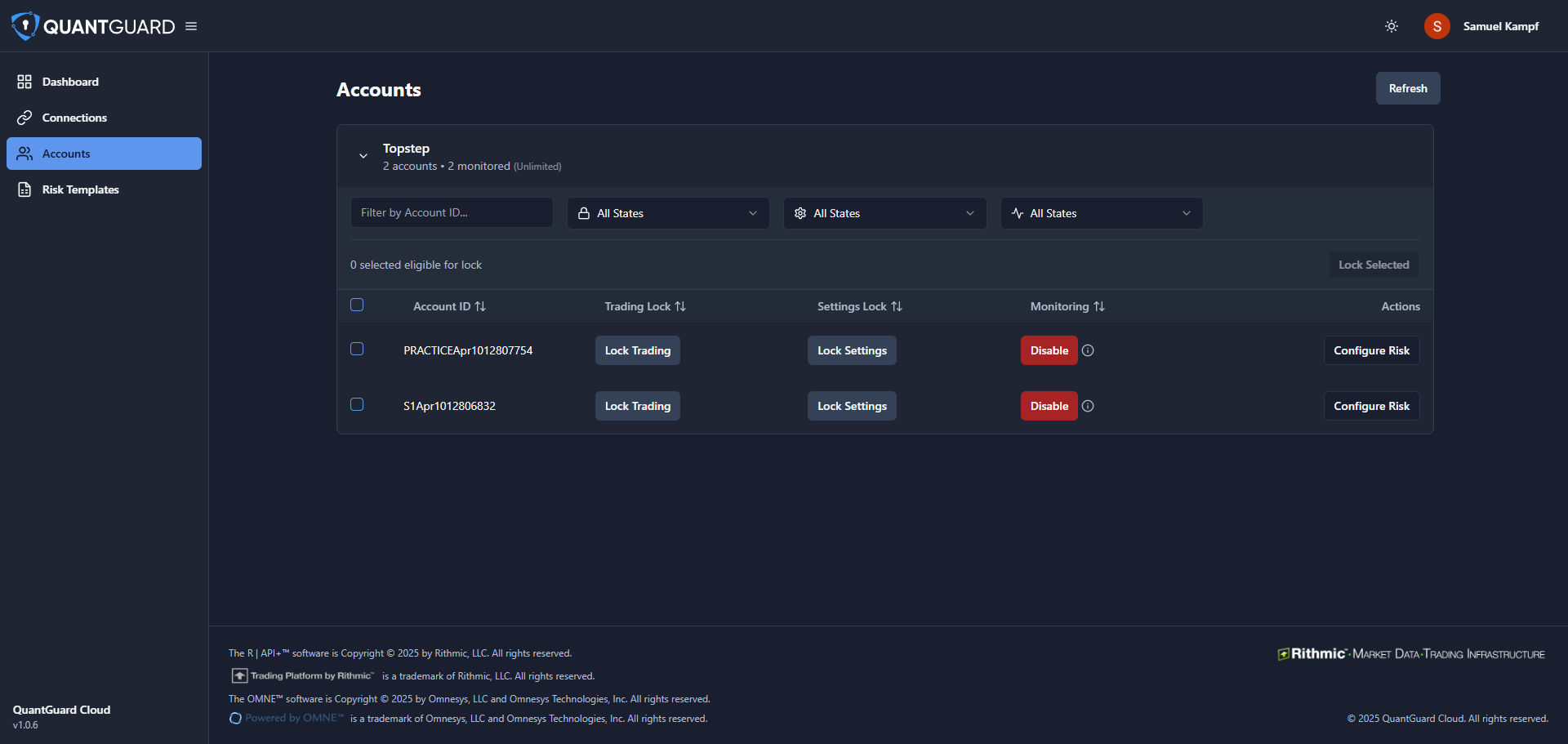

Can I use QuantGuard with multiple prop firms?

Yes! QuantGuard allows you to connect multiple accounts from both Rithmic and Tradovate, even from different prop firms, and manage their risk settings from a single dashboard.

What happens if my computer turns off or I get disconnected?

QuantGuard runs 24/7 in the cloud. Your risk rules continue to be monitored and enforced even if your local machine is off or disconnected from the internet.

Can I mix Rithmic and Tradovate accounts?

Absolutely! You can connect and manage both Rithmic and Tradovate accounts simultaneously from the same dashboard. Each connection maintains its own risk settings and monitoring.

Is my trading data secure?

We use industry-standard encryption and security practices. Your credentials for both Rithmic and Tradovate are securely stored, and all communication with trading servers is encrypted.

What other risk rules can I set besides DLL?

You can configure rules like Daily Profit Target locks, Maximum Position Loss, Maximum Order Size per Symbol, and restrict trading to specific time windows. These work across both platforms.

How do I cancel my subscription?

You can manage or cancel your subscription at any time through your account dashboard or by contacting our support team.

What is your refund policy?

All sales are final. As a digital service with immediate access, we do not offer refunds. We may consider exceptions within 14 days of purchase for customers who have not actively used the service. After 14 days, no refunds are issued. See our Terms of Service for full details.